Business guidelines – financial flows and a sustainable economy (sustainable finance)

Sustainable finance: Definition and reference to sustainability discourse

What is sustainable finance?

Sustainable finance is the term for a holistic approach to ecological, economic and social sustainability both in general and in terms of financial sector services in particular, thus leading to a channelling of financial flows and to sustainable management and projects.

The 17 global Sustainable Development Goals (SDGs) of Agenda 2030, to which Switzerland has also committed itself, form the reference framework set out in the Sustainable Development Strategy 2030. Switzerland has also set itself the target of zero greenhouse gas emissions by 2050. The Federal Council considers sustainable finance to be an excellent opportunity for the Swiss financial centre and a relevant competitive factor on the path to sustainable growth.

Some examples of ecological goals are climate protection and the preservation of biodiversity; examples of economic goals include, in addition to general economic growth, specific topics such as the promotion of innovation; examples of social goals include the promotion of health and equality. The three components of sustainability are not in competition with each other, nor are they ranked in order of importance; rather, they are mutually dependent. This concept can be illustrated by taking climate change as an example: climate change not only threatens habitats and livelihoods, but also up to 18 per cent of global GDP by 2050. Without an efficient and innovative economy that generates new technology and the funds for decarbonisation and the required resilience measures, climate goals will not be achieved, which would lead to unacceptable social consequences. However, the holistic sustainability approach of sustainable finance as a whole does not mean that individual financial flows or products cannot have a focal theme or give particular weight to individual dimensions or goals.

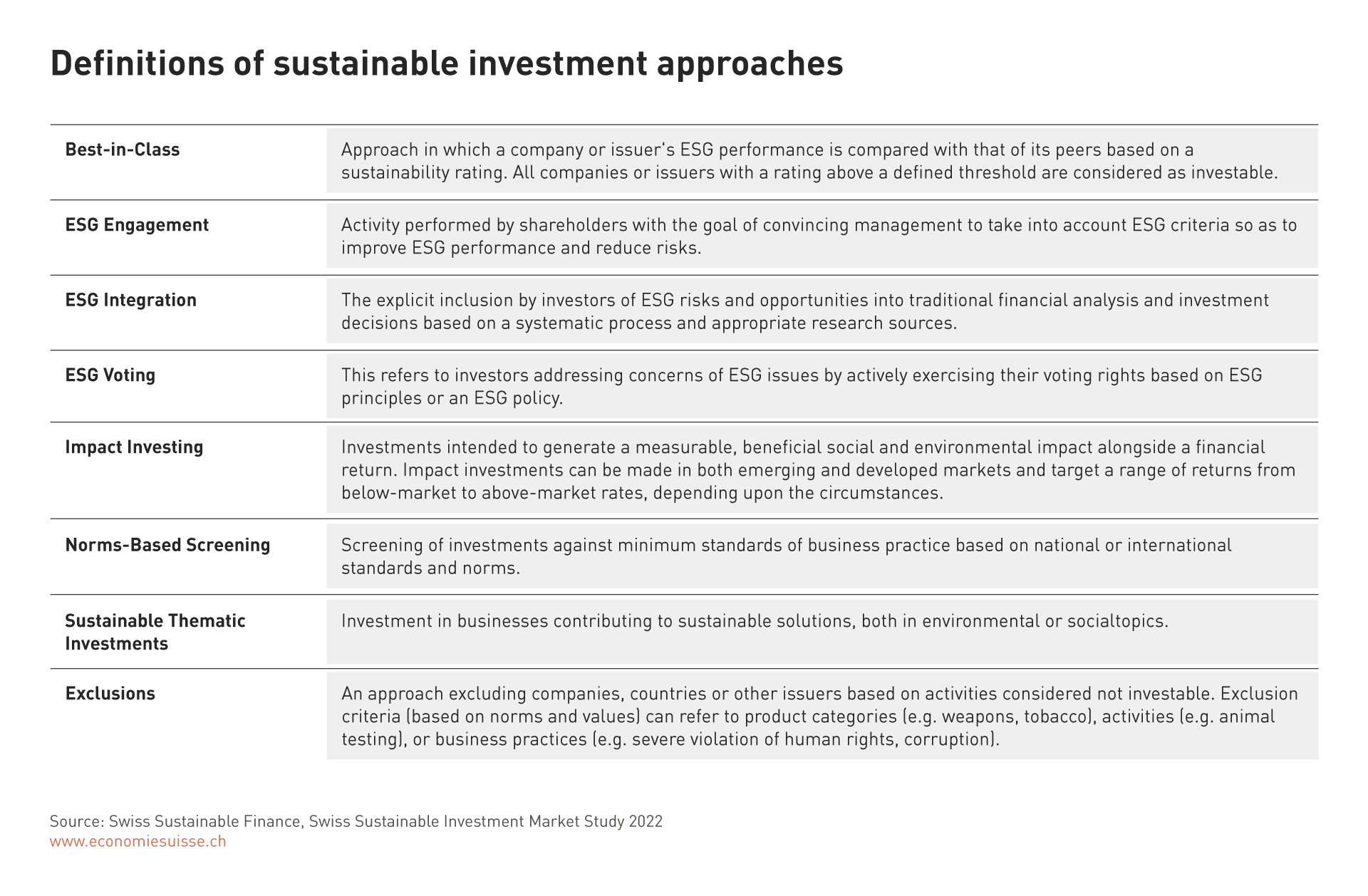

Instruments of sustainable financial flows are understood to be financing, assets and investments that are explicitly linked to one or more of the sustainability criteria. These include sustainable funds, green bonds, impact investing, microfinance and loans for sustainable projects, to name just a few. Various investment approaches are pursued that are classified as sustainable, from exclusion of certain investments, to selection of best-in-class investments, to active engagement as an investor and impact investing, where the goal is to have a direct impact on a situation.

The relevant players in terms of sustainable finance within the financial sector are institutional investors, which own or manage significant assets (asset owners), intermediaries that advise institutional and private clients (banks) and manage their assets (asset managers), insurers and banks as mortgage and corporate lenders, and capital market businesses. In addition to these players within the financial sector, the real economy is particularly important: it implements the transformation to a sustainable economy and offers appropriate financing options for sustainable products. However, legislators, regulators, NGOs and civil society organisations (CSOs) are also key players in the field of sustainable finance.

Despite all efforts, sustainable finance is not a magic bullet for sustainability. Rather, it is an essential component of sustainable economic activity that works alongside adequate and conducive framework conditions, a sustainable real economy and sustainable consumer behaviour. The federal government’s Sustainable Development Strategy 2030 sets out how the various sectors can drive forward and advance the goals and the framework conditions necessary to help strengthen Switzerland as a business location. The strategy is focused on balancing supply and sustainability-driven demand in a market economy. Regulation is supplementary to these measures, as was also explicitly emphasised by the government in terms of sustainable finance.