Business guidelines – financial flows and a sustainable economy (sustainable finance)

Opportunities and challenges of sustainable finance

Why opt for sustainable finance?

Sustainable finance has great potential to strengthen sustainable business through specific financial flows and to raise general business awareness of market-driven sustainability. This applies in particular to Switzerland, which is a globally important business centre and home to key players in both the financial and real economy: Switzerland is a leading financial centre with more than 9 trillion Swiss francs in the custody accounts of Swiss banks and loans. Switzerland manages about a quarter of the world’s cross-border assets. Switzerland is also a globally important location for the real economy, home to numerous leading domestic and international companies that can offer sustainable investment opportunities. The study Klimastandort Schweiz by McKinsey & Company, in which economiesuisse participated, showed that in the context of environmental sustainability, Switzerland’s strong real and financial economy has at least an indirect influence on emissions of up to two gigatonnes of CO2 equivalents. In comparison, Switzerland emits less than 50 megatonnes domestically.

Sustainable finance is therefore a key topic for Switzerland as a business centre. It is rapidly gaining in importance and has profound implications for the financial and real economy. Sustainable investment already represents a significant volume of the Swiss financial centre – almost 2 trillion Swiss francs – and this volume is continuing to grow rapidly at an annual rate of almost 50 per cent over the last decade, is increasingly becoming a key client need. Sustainable finance is important for the financial sector for three reasons: financial performance (risk and return), value alignment with its stakeholders, and the drive to bring about positive change. Switzerland has the opportunity to become a leading centre of sustainable finance, but in order to do so, the financial centre needs optimal political framework conditions so that competitiveness is continuously improved and the financial sector is able to make an effective contribution to sustainability.

The real economy contributes proactively to the achievement of sustainability goals and there is an interaction with sustainable finance in its business and financing activities. For example, if companies fail to convince investors that they are ‘investable’ based on sustainability criteria, this can lead to higher capital costs and thus a market disadvantage. Conversely, companies that contribute to the achievement of sustainability goals increasingly have competitive advantages.

However, sustainable finance also brings with it considerable challenges. For the financial sector, the availability of valid, high-quality financing, asset and investment opportunities, and transparency are central factors (keyword: greenwashing). For the real economy, the high transaction costs and bureaucracy (e.g. for measurement and reporting) threaten to become a major burden. Moreover, financial institutions are also subject to disclosure obligations. Large banks and insurance companies are already required to disclose their climate risks to FINMA in accordance with the Task Force on Climate-Related Financial Disclosure (TCFD).

Due to the increasing importance of sustainability, non-sustainable business models run the risk of losing capital (stranded assets). Finally, sustainable finance is an extremely rapidly developing area at national and international level, which leads to a need for action in both the financial and the real economy and requires a high level of flexibility and adaptability. This may mean some sub-standard interim solutions. Ultimately, the increasing importance of sustainable finance also harbours the danger of arousing political ambition. Indirectly, massive interventions in the economic system may occur that call into question fundamental requirements of the free market, such as technological neutrality and the prevention of industrial policy.

Why implement guidelines?

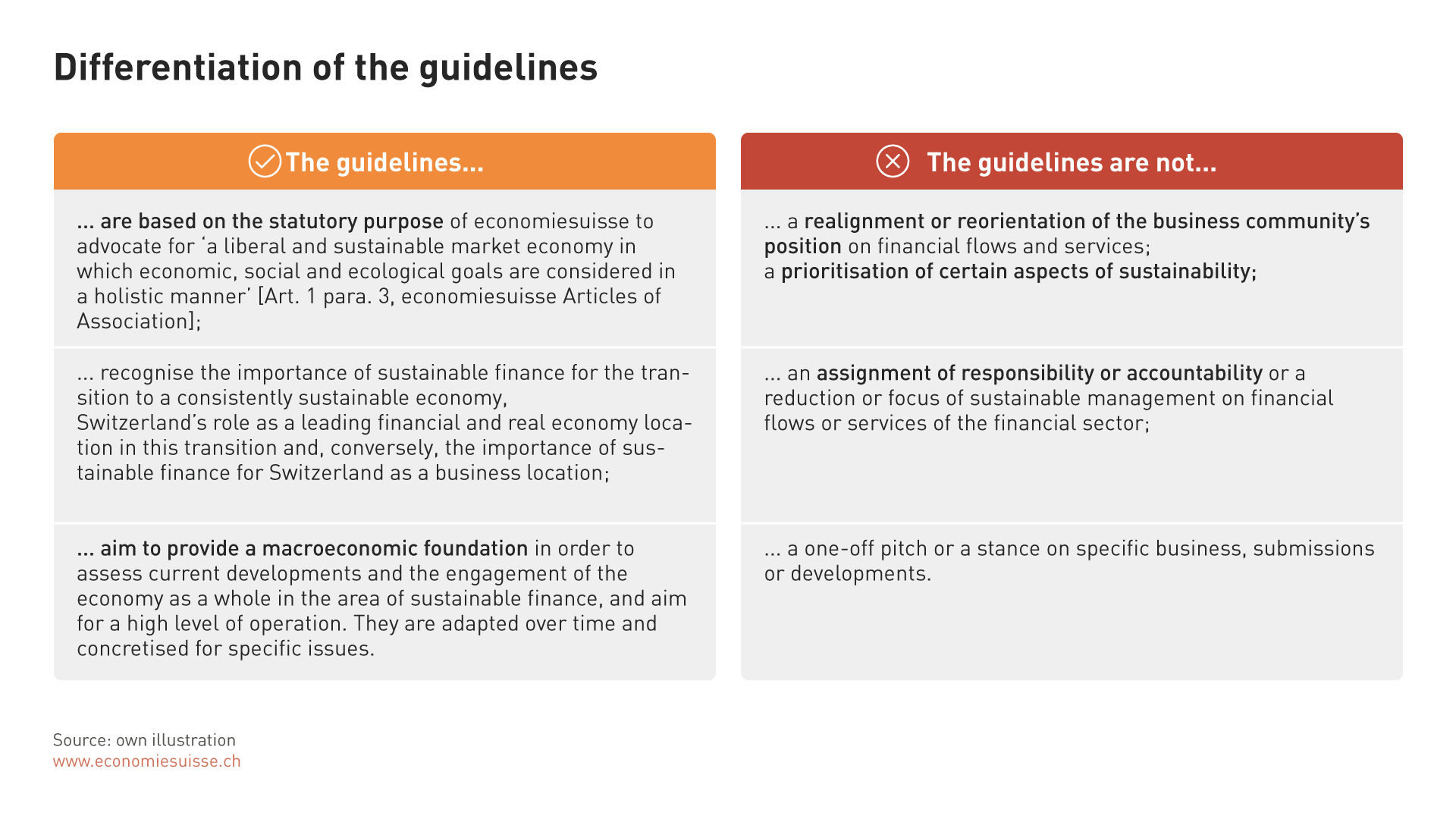

The purpose of these guidelines for the Swiss economy is to provide an initial, macroeconomic foundation that will serve as a collectively developed ‘north star’ to follow in the rapidly evolving environment and enable proactive, dynamic positioning in individual businesses. More specifically: