Business guidelines – financial flows and a sustainable economy (sustainable finance)

Framework conditions for successful sustainable finance

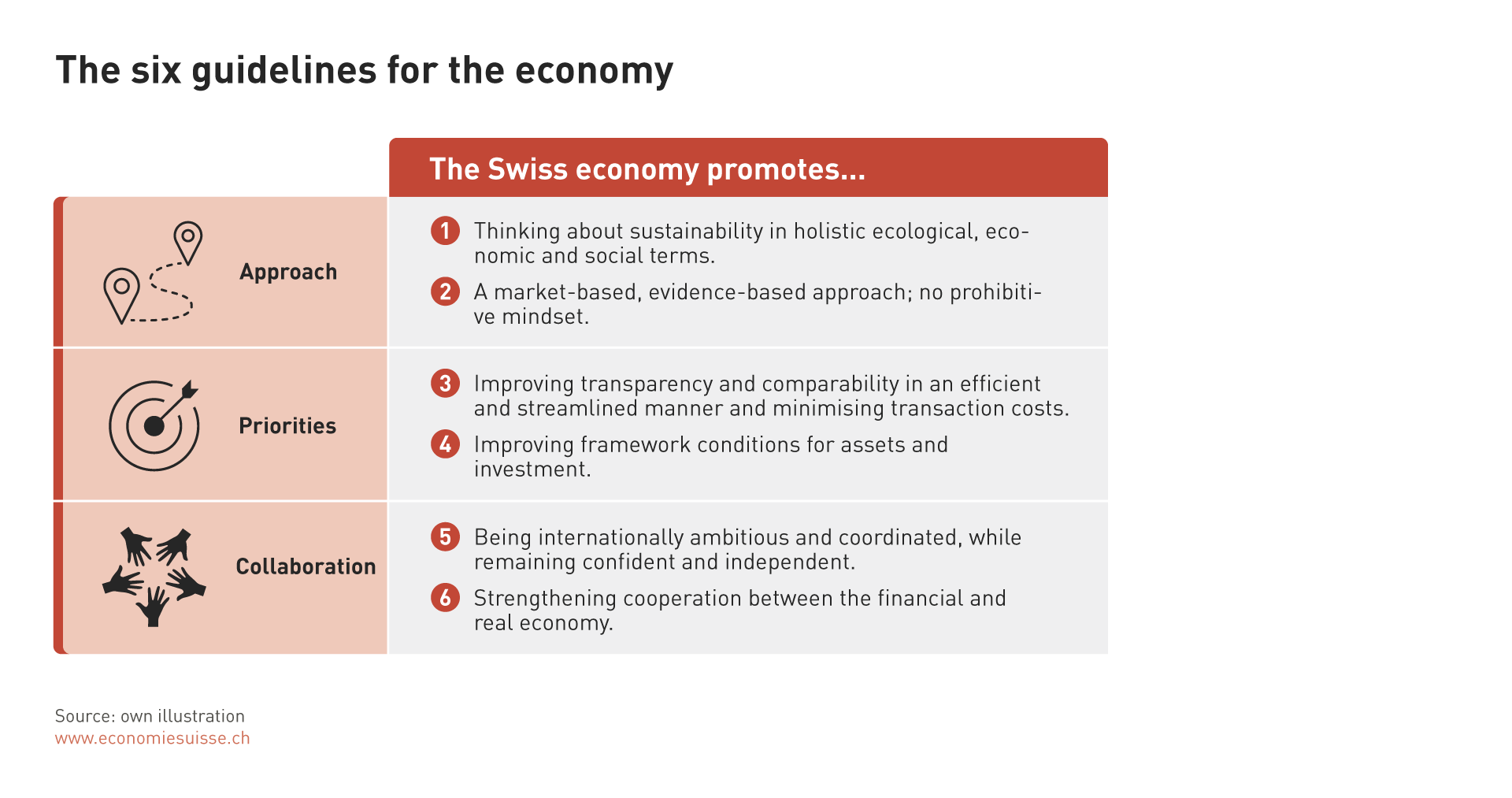

In order to take advantage of the opportunities offered by sustainable finance and also address challenges, the economy as a whole has set itself the following guidelines:

1. Consider ecological, economic and social sustainability holistically

The umbrella organisation of the business community, economiesuisse, is committed (see also Art. 1 para. 3 Articles of Association) to a liberal and sustainable market economy in which ecological, economic and social goals are taken into account holistically. A liberal, sustainable market economy places free, autonomous individuals at the centre. It relies on individual responsibility and innovation and only secondarily on regulation and the state. A liberal, sustainable market economy improves competitiveness, preserves natural resources, strengthens social cohesion and thus enables future generations to have a future worth living. In the context of today’s debates on climate targets, sustainability is often wrongly reduced to its ecological dimension, which does not do justice to the comprehensive nature of sustainability. The Swiss business community understands sustainability and sustainable financing to mean all levels of sustainability and considers the ecological, economic and social goals to be mutually dependent.

2. Take a market and evidence-based approach; no prohibitive mindset

The Swiss business community demands that the sustainability efforts of all companies are taken into account and that all companies are given the opportunity to adapt their business model.

This cannot be achieved by delimiting individual economic activities in a rigid black-and-white system. Sustainable financing must enable innovation and is an opportunity to provide targeted support in reaching their goals to companies that are making a transition to greater sustainability. This applies in particular to emission-intensive sectors, as it is precisely in the sectors that have a lower standard but a high transformation potential that the incremental benefits of sustainable investments are high. A lack of differentiation in the audit requirements also means that investments to gradually improve sustainability performance are often unlikely to prove worthwhile in practice, which would subsequently slow them down. Regulatory financing restrictions and prohibition of legally permissible business models and products under the guise of sustainable finance should therefore be strictly rejected. Such an approach prevents innovation and does not support goals, leading only to a shift to other financial centres not subject to the rules.

Investors and the private banking sector should continue to be able to use their discretion with regard to corporate financing to determine which companies or technologies they consider particularly promising. Legal requirements are to be used on a secondary basis where they significantly accelerate the process without massively impairing economic performance. Incentive is always preferable to prohibition; for example, innovation and technical upgrades are the primary means to reduce environmental impact or energy demand.

3. Improve transparency and comparability in an efficient and streamlined manner and minimise transaction costs

The Swiss business community supports increased transparency regarding the sustainability-related impacts and opportunities and risks of financial flows, provided that this is proportionate, practicable and comprehensible for both the financial and real economy. The creation of transparency enables access to sustainability criteria and allows companies to understand the effects and risks of their activities in relation to sustainability.

In principle, the obligation to publish information on activities classified as sustainable in the context of non-financial reporting must be based on the principles of financial reporting and in an internationally agreed context. In terms of the ‘comply or explain’ concept, flexibility is preferable to rigid regulation. In addition to the need for transparency, long-term focus and comparability of information are necessary in order to consider the effects and risks of financing decisions. Where measurability and comparability are not possible, the necessity and possibility of metrics must be critically analysed.

Lean solutions that do not lead to ecological, economic or socially unacceptable transaction costs must be found. It is important to bear in mind that companies in Switzerland are structured and sized differently and do not have equal resources. Transparency requirements must be structured in such a way that even smaller companies can implement them. Conditions should therefore take into account the varied nature of the Swiss corporate landscape.

4. Improve framework conditions for assets and investment

The Swiss business community calls for the reduction of tax and administrative hurdles for sustainable financial instruments and offers (in particular where they effectively make certain investments impossible), which conversely should not result in a better position – a level playing field is required. In addition, the business community calls for the promotion of sustainable investment through appropriate framework conditions. Swiss financial institutions and companies need adequate international market access so that sustainable financial services and instruments can be exported. There are currently signs of excess demand in the area of sustainable finance. In order to boost the dissemination of sustainable products and services, the financial centre depends on a favourable environment. In the interaction with the different economic players in particular, a differentiated approach tailored to the various banking transactions is important.

Above all, the regulatory framework must be designed in such a way that corporate profits are invested in research and development as far as possible and do not have to be paid in the form of taxes. The state must create the conditions for an innovative economy, not restrict it. This includes limiting government debt in order not to diminish the innovative power of companies via taxes or a monetarily unstable environment.

5. Be internationally ambitious and coordinated, while remaining confident and independent

Easily available and, above all, comparable information is an important prerequisite for a functioning market. Switzerland needs to develop its position as an innovative and progressive business centre. International developments must be taken into account in a pragmatic and proportionate manner where necessary and appropriate, and a connection to the international environment must be ensured. In case of doubt, a ‘Swiss Finish’ should be avoided. At the same time, the business community is opposed to ‘anticipatory obedience’ and asks for a gradual adaptation to ambitious international standards, if and when these have been proven and established, and following an evidence-based approach. The incorporation of international recommendations into Swiss legislation should be principle-based.

6. Strengthen cooperation between the financial and real economy

Sustainable finance results from the demand for a sustainable real economy; conversely, sustainable finance can also be a means to provide incentives. Sustainable finance and the real economy are thus closely linked. For this reason, both the real and financial economy must be involved in sustainable finance at an early stage and considered comprehensively in terms of all developments. Forums and mechanisms for exchange and collaboration must be strengthened. Market-driven coordination on possible areas of action and self-regulation along the lines of technical developments and modern scientific teaching is preferable to a restrictive, rule-based approach or specifications such as taxonomies. The latter are often politicised, reactive and unable to do justice to the dynamics of the market.